As a business owner, you would want to stay on top of your finances and make informed executive decisions. Adequate Bookkeeping possesses the required skills of this business model along with an in-depth knowledge of this industry and the prevailing challenges. As a result, we understand your wholesale business a lot better and assist you with our accounting and bookkeeping solutions to improve your business performance. A wholesaler should not be confused with an “official distributor” for a brand’s product line.

When you become our client, we learn all we can about how your business operates, and then create a package of accounting services that’s in line with your needs and goals. Thanks to the innovative invoicing tool from FreshBooks, you can send invoices in just a few clicks. To get the most out of this feature, customize your invoice template with your business’s branding materials.

Winning Back-Office Strategies to Boost Your Business Agility

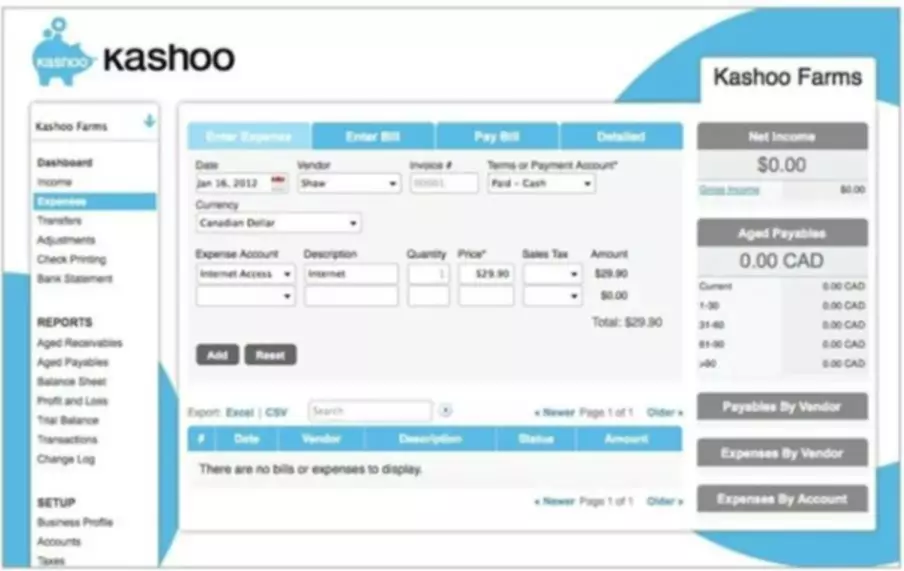

Mismanaged inventory can lead to missed opportunities, lost customers and higher costs — problems that become exponentially larger when you have… Dimensional reporting allows you to define transactions how you want, enabling you to drill down into your financials to better manage budgets, assess cash flow and much more. That’s why our accounting software now includes double-entry accounting – an industry standard feature that helps you keep all of your debits and credits in check with ease. Meanwhile, this tool comes in various pricing methods and flexible pricing.

- But when a lot of companies shifted their operations to the internet, many industries experienced a resurgence.

- Because accounting for wholesale distribution usually transfers a considerable amount of merchandise in and out of their warehouses…

- With our high degree of experience with retail accounting and wholesale accounting, we know exactly what services you will need in order to spend your time focusing on what really matters to you.

- It offers tools to easily manage suppliers, control costs, and optimize expenses.

- If you operate a distribution company, you’re right in the middle of the supply chain havoc resulting from the COVID-19 pandemic and the ensuing…

- When gas prices go up, for example,

your costs are affected and you must react quickly.

His main areas of expertise are blockchain technologies, cryptocurrencies, and the use of biometrics in fintech solutions. His work has been frequently quoted by such publications as Forbes, USA Today, Entrepreneur, and LA Times. With more than 1,800 solutions scrutinized in the last 5 years spent on our team he always prioritized offering readers an unbiased perspective on modern financial technologies. Aside from the abovementioned, the platform also comes with analytics and reporting tools that allow you to keep a close eye on any transactions. This way you can accelerate workflows seamlessly and ensure no transaction is overlooked.

It lets you track inventory in real time, which is crucial to manufacturers and wholesalers. You can also organize your inventory with product details like vendor details, SKU, product image, and on-hand stock. FreshBooks ensures you get paid faster for your sales and spend less time on your small business accounting. Add a personalized thank-you note and send your invoice directly from your account.

Take control of your business accounting with the help of these integrations. The accounting software for distribution packages starts as low as $15 a month. With accelerated digital initiatives, a lot of companies incorporated technology into their workflows. This allowed the parts of the manufacturing workforce to perform their duties remotely.

Separate Records For Personal And Business Transactions

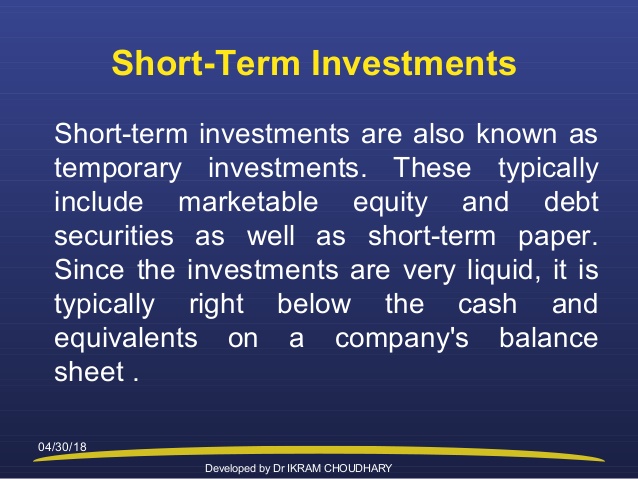

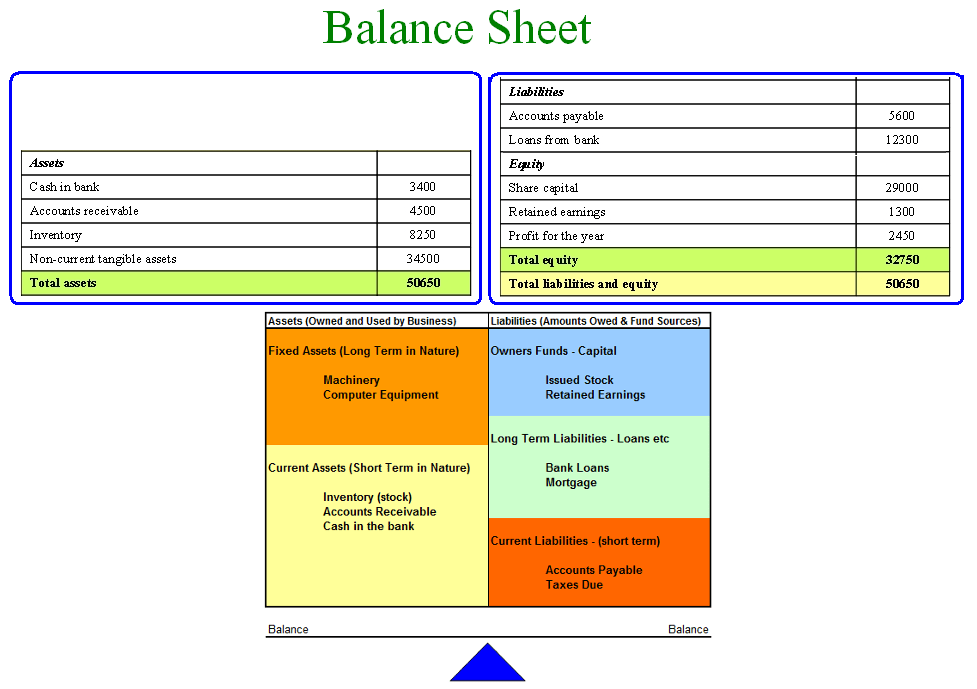

However, generally accepted accounting standards require businesses to value inventories at a lower cost or market. Properly managed cash flow results in fully sustained business activity, such as business operation, due date receivable-payable, investment, and others. A distributor accounting company requires more diverse accounts than others.

Prime Financial Group Limited Provides Earnings Guidance for the Fiscal Year 2024 – Marketscreener.com

Prime Financial Group Limited Provides Earnings Guidance for the Fiscal Year 2024.

Posted: Mon, 21 Aug 2023 23:45:00 GMT [source]

Purchase and sales orders enable you to communicate requirements with vendors and confirm sales before shipping, respectively. It also helps you prepare for the tax season by accurately keeping track of your tax liabilities. The platform also offers a robust infrastructure that provides quick access to your company’s payroll, financial data, People Analytics, and more.

Our accounting and tax services for wholesale distribution businesses include:

Customers can pay you by credit card directly from an invoice with just a couple of quick clicks. With high-level encryption and first-class security, your clients never have to worry about payment protection. FreshBooks offers a transparent, affordable fee structure to remove the guesswork from online payments for your business. Make the billing process as simple as possible for your business and its customers. FreshBooks accounting software allows you to set up billing schedules so your clients can pay automatically and securely by credit card for your services, without having to think about it. Clients save time and your business gets the financial security of knowing exactly when payments come in.

In fact, creating proposals and quotes can also be streamlined as these documents can be quickly transformed into invoices and sales orders. Furthermore, it has at-a-glance dashboards, expense management, and single-click reports. Rossum is an all-in-one gateway for managing documents but due to the flexible nature of its interface, it can easily be used for accounts payable processes and the like. With this, you can collect all your pertinent documents in one feed and filter them quickly. It also leverages a self-learning AI technology that will allow automatic data capture.

Wholesale and Distribution Company Services

FreshBooks allows you to put major tasks on your bookkeeping to-do list – like invoicing, creating expense reports and generating business insight reports – in cruise control. Whichever business accounting software you choose, remember that you aren’t committed to it for life since most platforms allow for some form of conversion. You also have to factor in your company’s system, particularly its compatibility with the software’s features. At the end of the day, you can overcome the effects of COVID-19 with a tool that fosters seamless remote work.

Quickbooks Online simplifies accounting for your business, as well as financial management. All the essential accounting tools are in a single platform—promoting efficient operations and giving you more time to focus on tasks that will grow your business. To update your records, keep a proper paper trail of all your business transactions. Keep copies of bank statements, invoices, bills, and receipts to provide a clear record trail for auditing your business transactions. This will not only help you manage your finances but also make tax time convenient.

Make it a habit to update your records regularly, whether it’s daily, weekly, or monthly. If you’re not comfortable with bookkeeping, consider hiring a professional to keep your records updated for you. You can even hire an independent bookkeeping expert at a lower cost than a full-time record-keeping firm. It’s exciting to start a wholesale business, but it’s essential to keep your personal and business finances separate.

It hosts a suite of tools that are meant to help users manage all aspects of their financial operations–from running payrolls to managing expenses. If manual processes in your accounts payable are negatively affecting your manufacturing business, then it’s time to give Yooz a try. It’s also one of the most secure accounts payable solutions available that can fit the needs of small and mid-sized businesses as well as large manufacturing companies.

With Gusto’s accounting features, you can easily help your clients when it comes to regulatory changes on statutory compliance, maintaining revenue, and more. In this case, the wholesaler distributes access to mutual funds to companies that wish to make them available to investors. Mutual fund wholesalers are compensated from the fees of the mutual funds they sell.

Keeping track of all your wholesale business’s finances might be difficult, but syncing your bank statements can help. Request that your bank synchronize all of your statements at the end of the month. Keep all your business’s financial records secured, more especially consider storing all your files offsite in the event of any natural disaster or fire. When your business records are stored offsite in a secure server, it will be easy for you to retrieve all your financial records in case of any event. When you make a purchase, you must record the expense in your accounting books. You can record your expenses for wholesale items in the same way you would record any other purchases.

Gravity’s seamless integration to Microsoft’s world class CRM system (aka Dynamics 365 CE) enables companies to track from lead to sale. You need cloud accounting software for your wholesale business that simplifies the bookkeeping process. That way, you can spend more time making sales and growing your business and less time tied down to Wholesale accounting a desk. FreshBooks offers best-in-class accounting tools designed with your small business in mind, so you can ditch the complicated calculations and time-consuming spreadsheets. Its suite of products works together to offer a streamlined accounting software that keeps your finances in order, even when you’re busy closing another sale.

Also, with an efficient ERP software, you get real-time access to your live financial data so you can monitor and make timely decisions. In addition, it supports accounts receivables, accounts payables, tax management, and cash management, among others. Sales never stop rolling in when you work in the wholesale industry, so you need to be able to do important work anytime and anywhere.